Homeowners Insurance in and around Wheeling

Protect what's important from the unanticipated.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

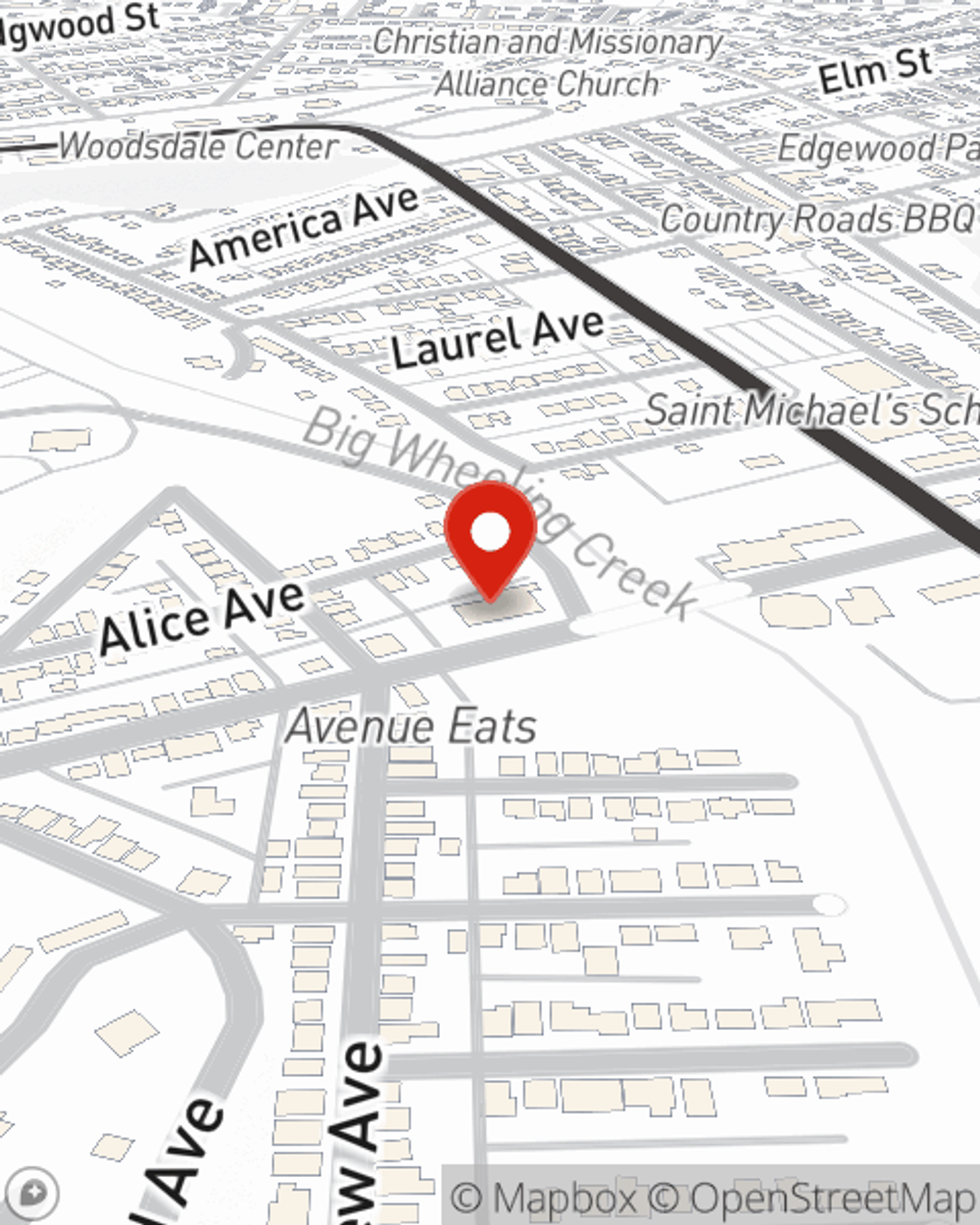

There are plenty of choices for home insurance in Wheeling. Sorting through coverage options and deductibles is a lot to deal with. But if you want great priced homeowners insurance, choose State Farm. Your friends and neighbors in Wheeling enjoy impressive value and no-nonsense service by working with State Farm Agent Jessica Hoskinson. That’s because Jessica Hoskinson can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as collectibles, swing sets, cameras, pictures, and more!

Protect what's important from the unanticipated.

Give your home an extra layer of protection with State Farm home insurance.

Why Homeowners In Wheeling Choose State Farm

That’s why your friends and neighbors in Wheeling turn to State Farm Agent Jessica Hoskinson. Jessica Hoskinson can help you understand your liabilities and help you find a policy that fits your needs.

As a dependable provider of home insurance in Wheeling, WV, State Farm strives to keep your valuables protected. Call State Farm agent Jessica Hoskinson today and see how you can save.

Have More Questions About Homeowners Insurance?

Call Jessica at (304) 230-4343 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.

How to protect your digital footprint

How to protect your digital footprint

Reduce your digital footprint, when visiting a website or entering info online, by minimizing the data you leave behind so that it’s not misused by others.

Jessica Hoskinson

State Farm® Insurance AgentSimple Insights®

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.

How to protect your digital footprint

How to protect your digital footprint

Reduce your digital footprint, when visiting a website or entering info online, by minimizing the data you leave behind so that it’s not misused by others.